Bear Doc said:forza orsi said:hill02 said:

What he said above.

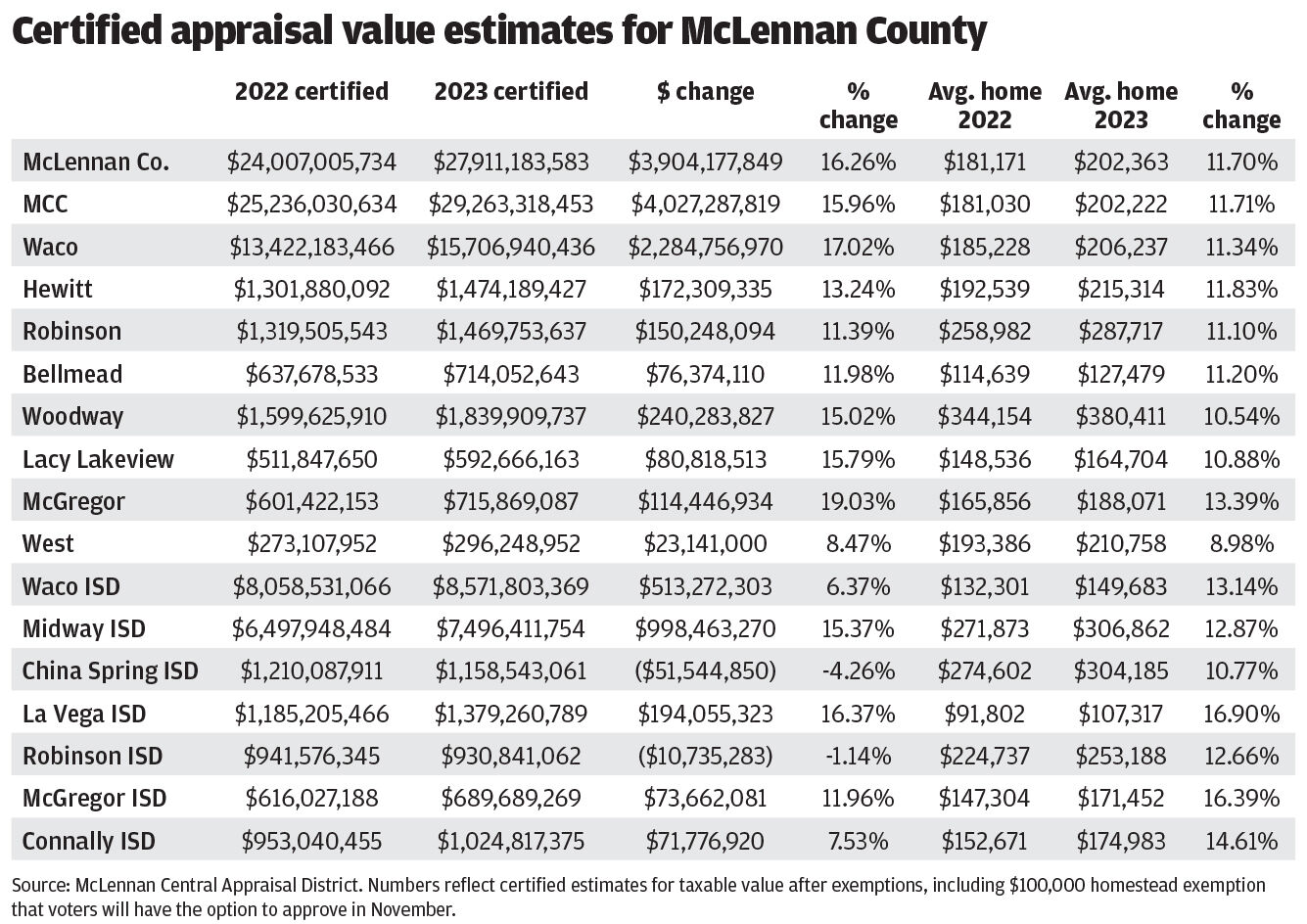

Property valuations have skyrocketed and MCAD takes zero responsibility.

What percentage have the annual MISD total budget increases been on average for the last 5-10 years?

That would provide a lot of clarity.

You can't just look at total budget dollars. The total enrollment of MISD is up about 20% from 2012-2022, from 7,266 to 8,739. New students = more schools, more teachers, more support staff. Then general US inflation is up 27.5% from 2012 to 2022.

For the fiscal year ending August 2012, the MISD budget was $53.7 million. If you apply the 10 year student enrollment growth rate and inflation to that you get $82.7 million. The budget for the fiscal year ending August 2022 was $75.3 million, less than that calculation above. That's not a perfect measuring stick and I'm sure there are places to improve efficiencies, but the budget dollars per student have gone down on an inflation-adjusted basis. I'm all in for cutting waste, but the budget growth in the district doesn't seem out of line.

Theoretically if the enrollment grows by 20%, then the tax base should grow by 20% as well offsetting that aspect.

Cannot argue about the inflationary issues though. That is a problem in every area or society.

Everything is going up except our salaries.