A few weeks back some technically accurate statistics were tweeted out by Bryan Fischer of FOX Sports (who also has worked for the PAC-12 Networks and covered USC) that really didn’t highlight how visible different leagues are.

In it he looks at:

- Just the first three weeks

- Lumps all cable together regardless of how much distribution a channel has

- Doesn’t limit the sample to home games which is what a given league TV deal will control.

To be fair, Fischer isn’t saying much beyond “here are the numbers” and much of what was discussed after was others running with what he posted to draw wild and out-of-context conclusions including but not limited to “the Big 12 is going to have 40% streaming!”.

Is The Big 12 To Expect 39% Streaming And To Be Way Behind The Other P5’s?

No. Not close to that. A few things need to be considered here.

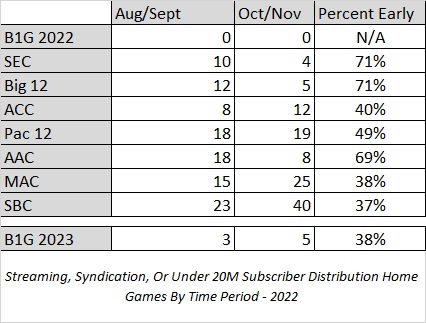

1 - September Has Basically All The Weak Non-Conference Games For ESPN+

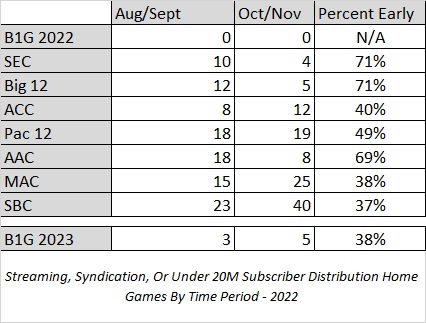

The Big 12 (and SEC) are really front-loaded on their streaming games. The weakest non-conference matchups tend to fit there and they usually are September-heavy. The two leagues had 71% of their streaming games before October. Only 5 games in 2022 were ESPN+ games for the Big 12 after September.

2 - Streaming Isn’t The Only Less Than Ideal Distribution Method

Other leagues benefit from low-distribution cable networks or from regional syndication which isn’t always ideal either. Below are the P5 leagues and the G5s with ESPN+ as a part of their deal with the games in 2022 that they had on any of these three delivery methods grouped by before or after the start of October. The Big 12 holds up really well overall and in particular in the last half of the season.

The ACC has a small syndication deal that gets tossed in alongside 3-4 streaming games while the under 15M subscriber PAC-12 Network hurts the PAC-12 here. For context, ESPN+ has around 25M subscribers.

As an extra, I included the three scheduled games on Peacock for the Big Ten in 2023 out of the eight they contract for as it’s the first deal of the new contracts to have a definite number that varies from the past. It gives a better picture of them going forward.

3 - The Total Percentage Of Home Games With Less Visibility Isn’t That High

In 2022 the Big 12 had 19 games that fell below the main TV contract to either Longhorn Network (2 games) or the streaming service ESPN+. That’s roughly 2 games per school and around 28% of the Big 12’s 2022 inventory of 67 games. Since the only other games in their contract almost always go on ABC, FOX, ESPN, ESPN2, ESPNU, or FS1 that means 72% were very widely visible on most cable systems and unless it’s one or two games that fall to ESPNU it’s visible on 90+% of cable homes.

What Would Be A Better Way To Look At League Exposure?

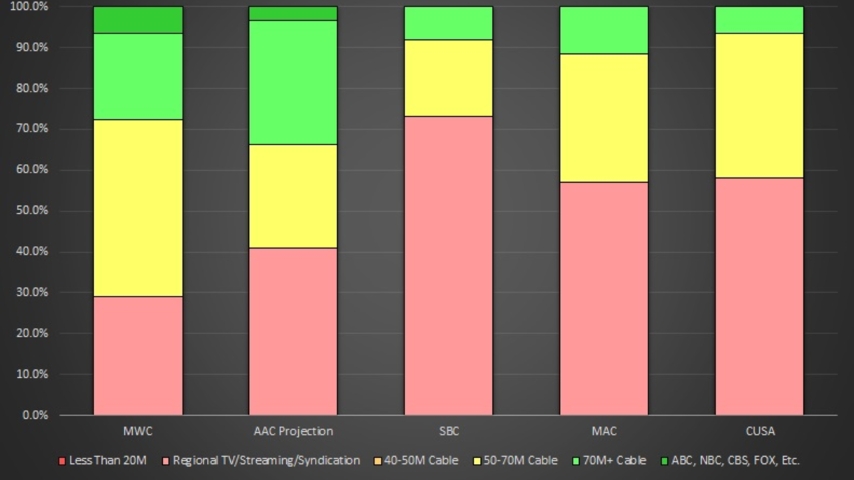

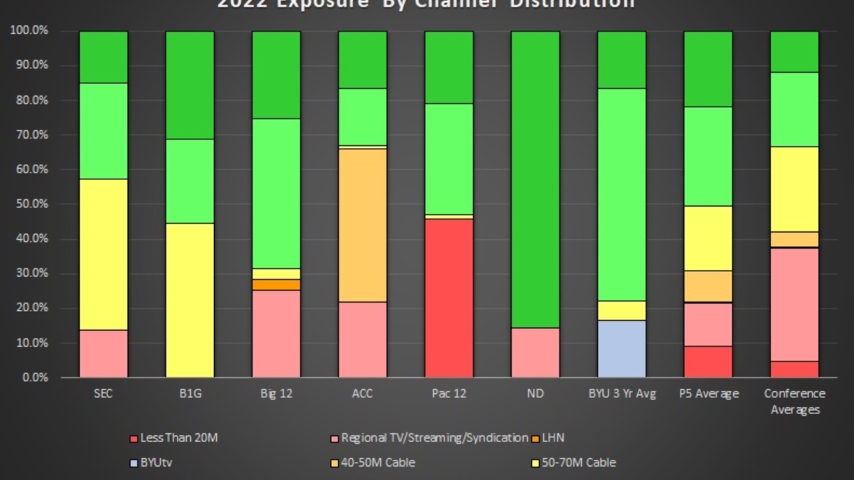

A better way to look at it is inventory distributed by each method and grouped by availability. When people look at streaming as a percentage it’s usually in the context of assuming something with much more reach is the comparison. So let’s take it a step further and differentiate between how visible each network is.

I have grouped each league’s expected home inventory by network type. I took the distribution numbers from the following two sources for cable networks and took the best number for each channel.

- SBJ gives beginning and end of 2022 subscriber counts for Nielsen networks

- Bryan Fischer tweeted out S&P Kagan numbers for several networks

- I did find a competing number for CBS Sports Network that was lower at 55M and informally was told it was around 50M

I have grouped them into:

- ABC, NBC, FOX, CBS: Your standard OTA network TV that hit almost every home (122M HH) and have a history of broadcasting college football.

- Around 90% of Multichannel (Cable) Homes or More: This is ESPN, ESPN2, and FS1 all coming in around 93-94%.

- Around 66% of Multichannel Homes: CBS Sports Network, FS2, SEC Network, BTN, and NFL Network.

- Around 50% of Multichannel Homes: ESPNU & ACC Network

- Regional TV/Streaming/Syndication: Options that aren’t as nationally consistent as the above. Regional & Syndication can be up and down while many streaming services like ESPN+ or AppleTV+ have a subscriber count on par with 1/3 of multichannel homes. Amazon is bigger but again it’s not to the point casual viewership is likely.

- Less Than 20% of Multichannel Homes: PAC-12 Network

- BYUtv or Longhorn Network: Networks that are pretty visible for the fanbase headlining the channel but won’t pull in casual viewers nationally very often.

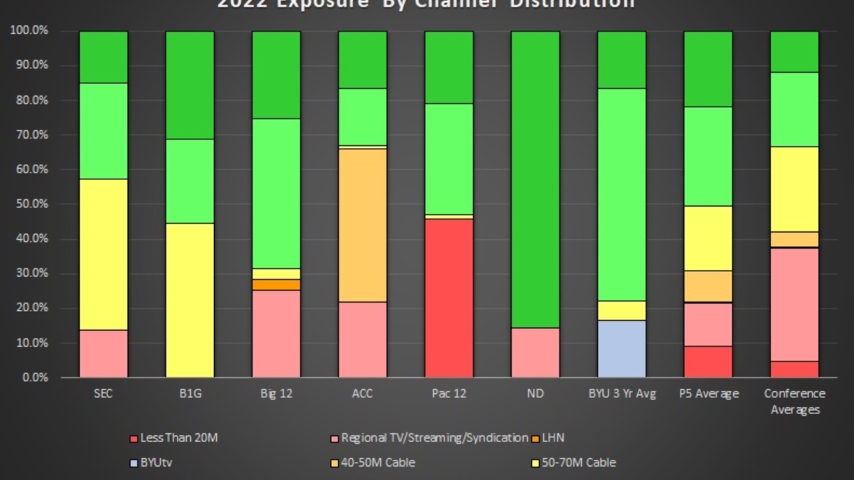

From here it’s represented as a percentage of the total home game inventory for the league in a stacked bar chart with the better distribution methods in darkest green and the worst in deep red.

How Did The Leagues Distribute Games In 2022?

Below we have the Power 5 conferences along with Notre Dame and BYU’s 3-year average for a more representative sample of what they’ve had in recent years. We see that the Big Ten was the most available with the most games on OTA networks and zero on streaming, syndication, or a low visibility network in the prior TV deal. The SEC had great visibility with only 14% on streaming and 38% on their 50M plus SEC network. The rest were either CBS or an ESPN cable channel. The Big 12 and ACC were neck and neck for No. 3. The argument for the ACC is with the Big 12 having more games on streaming than the ACC had either streamed or syndicated. The argument for the Big 12 is that a higher percentage of games were available on widely distributed channels -- all but 31% of games available to 90% of multichannel subscribers -- and a greater percentage of games were on ABC & FOX compared to the ACC.

SicEm365

2022 League Exposure By Channel Subscribers (Click To Expand)

The PAC-12 had great exposure with ABC, FOX, ESPN, ESPN2, and FS1 for all but one of its top 44 games which fell to ESPNU. However, the PAC-12 Network is making exposure difficult for the bottom half of its inventory and is among the worst distributed options. ESPN+ has around 10M more subscribers than the PAC-12 Network.

Notre Dame is getting tons of exposure with six games on NBC and one game on Peacock, NBC’s streaming option. BYU averaged roughly 5 games on their ABC/ESPN contract with one on ABC, 2 on ESPN, and 2 on either ESPN2 or ESPNU. One per year fell to BYU TV which has a ton of reach. Their 2022 season was all ESPN or ESPN2 before they hit a similar total on BYUtv. Rather than portray a scenario where they never had ABC games or never fell to ESPNU I chose to use the more representative 3-year sample.

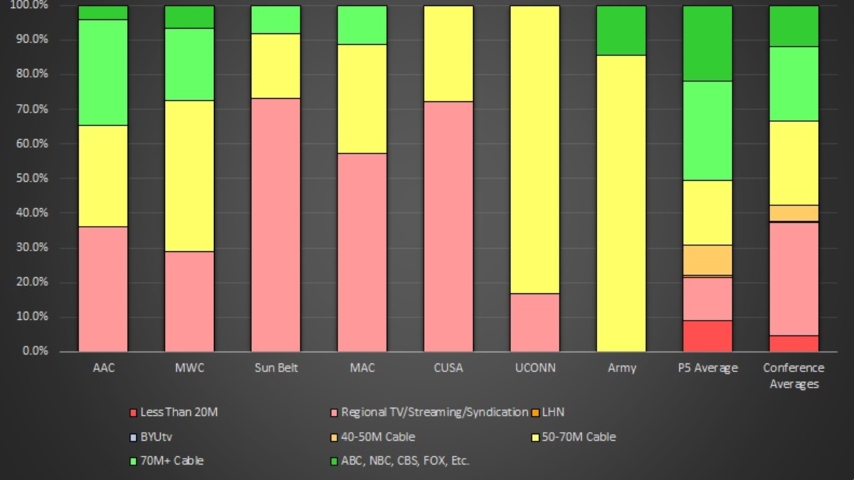

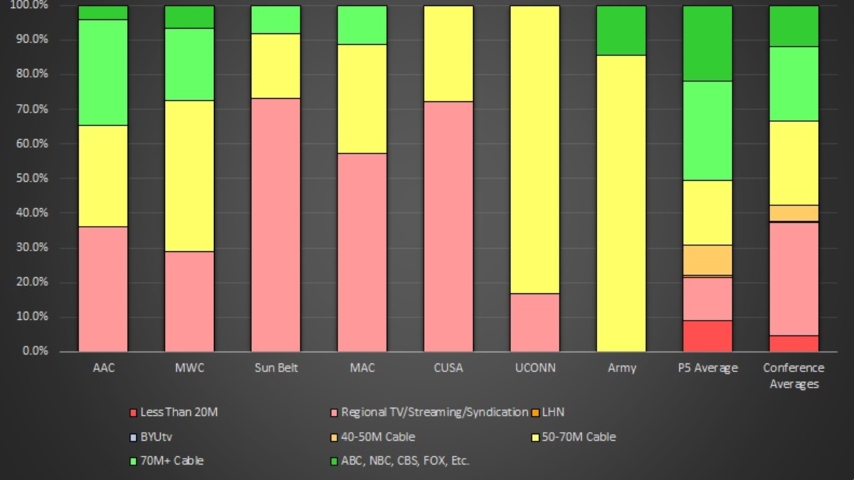

In the Group of 5, the American Athletic Conference and the Mountain West were the leaders. They each had 30-36% of games fall below the main TV deals with ABC/ESPN or FOX/CBS. Granted each had a lot of this on either ESPN2/ESPNU or CBS College Sports but their exposure on linear dwarfs the Sun Belt and MAC while those two have much better tier-one distribution than CUSA did.

SicEm365

2022 League Exposure By Channel Subscribers In G5 Leagues (Click to Expand)

UCONN carved out a modest exposure with CBS Sports Network on cable for most of their games while Army getting a game on big CBS and the rest on CBSSN gave them exposure on par with the better G5 leagues.

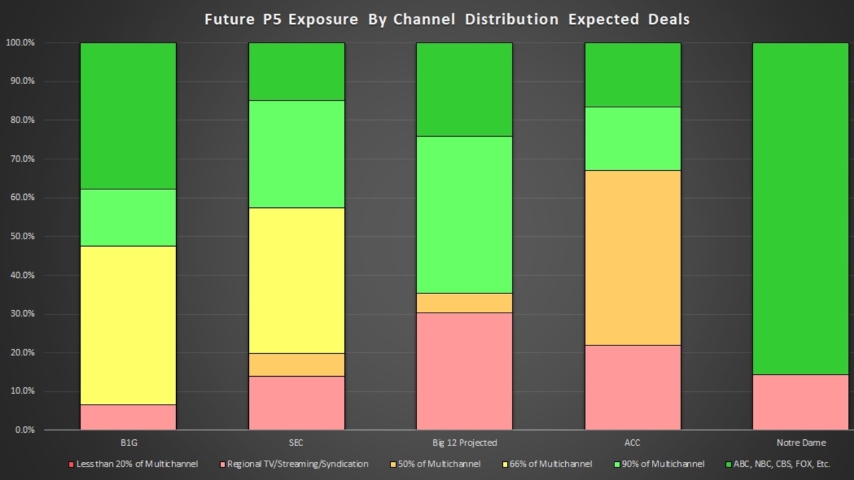

How Do The League Deals Project Going Forward?

I made an attempt to estimate how the shifting deals would impact the percentages for each league. I can elaborate further but in the interest of keeping this from getting even longer, I plan to post the rationale for what games shifted to which leagues below in the thread replies.

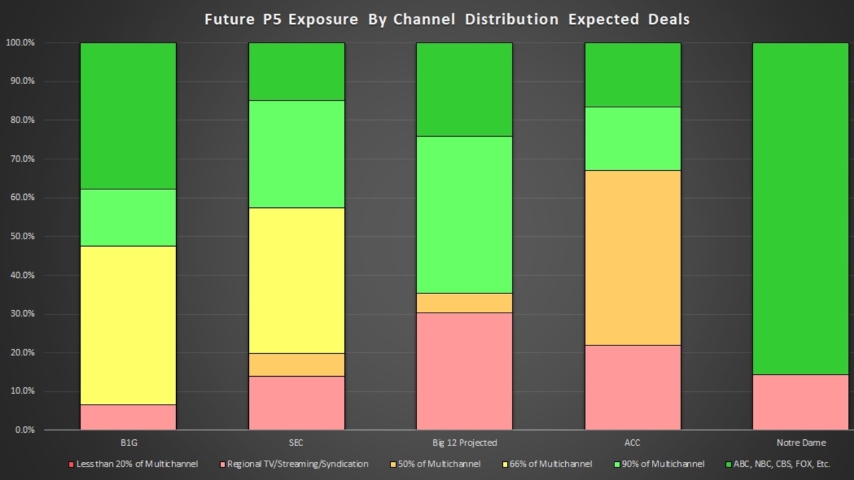

The Big Ten is probably the best off with the most games on established OTA networks, the fewest on streaming, and over 90% available to over 50M homes. The SEC is right behind them however with a deal that will look pretty similar to before except ABC replaces CBS.

SicEm365

Future League Exposure By Channel Subscribers (Click To Expand)

The Big 12 figures to be third as they have only around 30% on streaming but also project to have a solid distribution of games on OTA or on 70M+ subscriber channels. Given both FOX and ABC/ESPN are down in inventory (assuming neither gets 22 games from the PAC) it’s reasonable for the Big 12 to get similar window counts to before and pick up the BYU windows that the Cougars routinely carried. I project the Big 12 will take a couple of ESPN, ESPN2, and ESPNU windows from the AAC after raiding their top three brands.

The ACC has more games on linear but less on OTA and the ACC Network isn’t as widely available as FS1 or ESPN2 and carries much of the ACC’s content. Notre Dame rounds out this group with 6 games on NBC and 1 game on Peacock, NBC’s streaming service.

The PAC-12 is where things get unclear. There are a lot of unknowns here.

- Will they have to devote a certain amount of inventory to the PAC-12 Network or will they be able to scrap it?

- If they have to devote a certain amount, is it 36 games per year or just 3 games per school?

- If they go with a streaming partner (as is appearing likely) will it be all streaming or how much will be sublicensed to a linear partner?

- If they sublicense, will they need more than 2 games per week?

In the chart, I have projected each new scenario assuming they need only 30 PAC-12 Network games compared to the 36 they usually run (minimum I could guess if they keep it alive) and projected a streaming-only scenario and sublicensing 2 games to ESPN per week (28 games) under 10 and 12 team configurations. Additionally, on the left we have their prior deal as a comparison.

SicEm365

PAC-12 Exposure Scenarios Assuming Streaming Partners

This really illustrates that their overall exposure will struggle but also that if they force a streaming partner to sublicense two games per week to a linear partner they really need to expand to have enough inventory for the streamer to push subscriptions. At ten teams they either have to have fewer than 30 PAC-12 Network games (6 less than prior years already) or they leave very little for their new partner to work with. With only 65 games of estimated inventory, that only leaves 37 for both the streamer and the PAC-12 Network to split, roughly 2.64 per week over 14 weeks. That isn’t a lot to work with and a 12-team setup would allow for 3.57 per week to split.

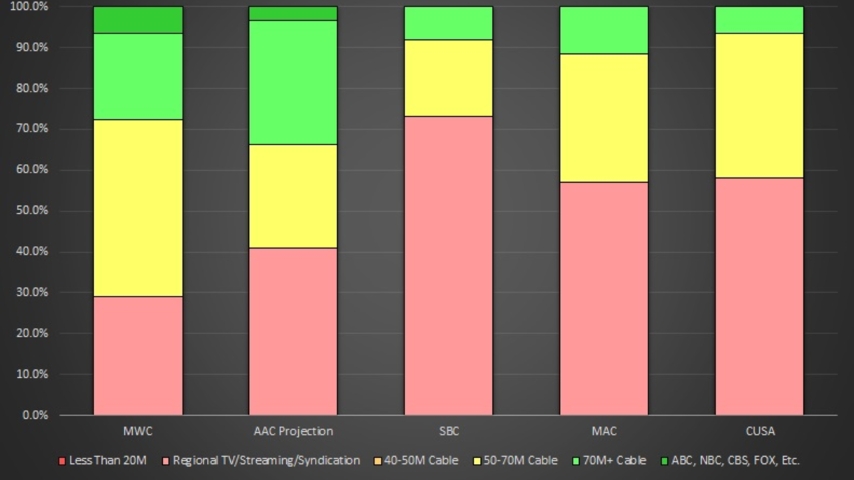

The G5 reshuffled a bit after the AAC lost three schools to the Big 12 but raided 6 from C-USA while C-USA begins a new deal. The AAC probably keeps a similar but slightly smaller total of games broadcast on the ABC/ESPN networks but as a percentage of a league with five more teams the percentage reaching good networks falls dramatically. This paints the MWC as probably the most exposure-laden league but FS1 also performs poorer than ESPN so it’s a debate.

SicEm365

Projected Exposure Under New G5 Contracts (Click To Expand)

The Sun Belt & MAC will remain similar while CUSA gets 13% on the ESPN, ESPN2, and ESPNU combo while getting a slightly higher percentage on 66% or so of cable homes.

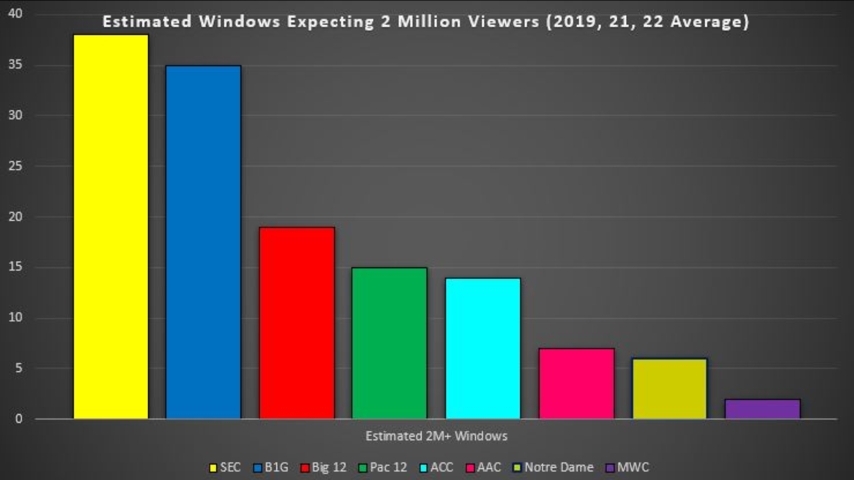

How Many Big Viewership Windows Are Set To Each League?

Not all games on ESPN are equal. Being placed in the “After Dark” spot implies 1.66M as an expected viewership. Prime time on a typical Saturday? 3.16M is the expectation and if you get the spotlight game on Labor Day in prime time you can expect just under 5M. Every single game since 2018 that went for over 4M viewers except for two came from windows that are expected to get over 2 million viewers. The exceptions? The Zero Week 2019 UF-Miami game and the 2018 PSU-Michigan game which was on ESPN. So those windows can help a lot to say the least.

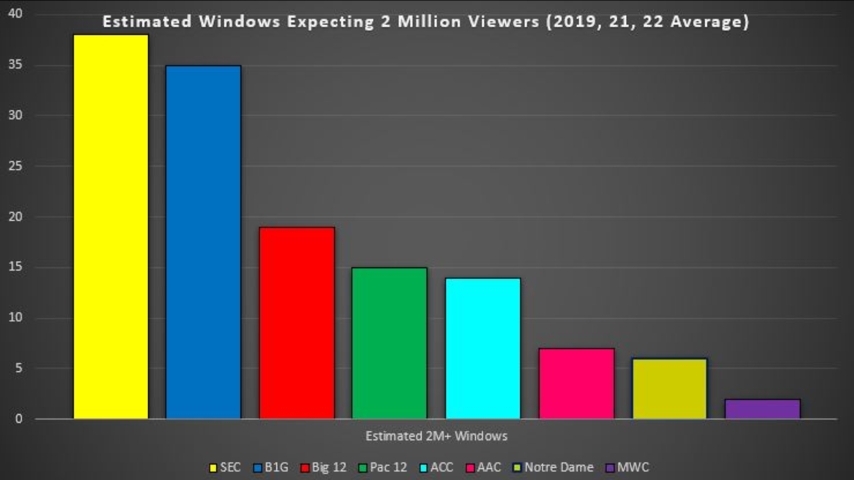

So across all networks which leagues have had the best platform for bigger viewership and which ones project to going forward?

SicEm365

2 Million Viewership Window Games By League 2019, 2021, & 2022 averages. (Click to Expand)

In recent years the SEC was out in front while the Big Ten was right on their heels. After that, the Big 12 was a comfortable third with the PAC-12 and ACC neck and neck. The American was the class of the G5 exposure but didn’t have a ton of huge TV windows as Notre Dame alone almost matched them with 6 NBC games annually. The Mountain West’s contractual minimums with FOX & CBS round out the list.

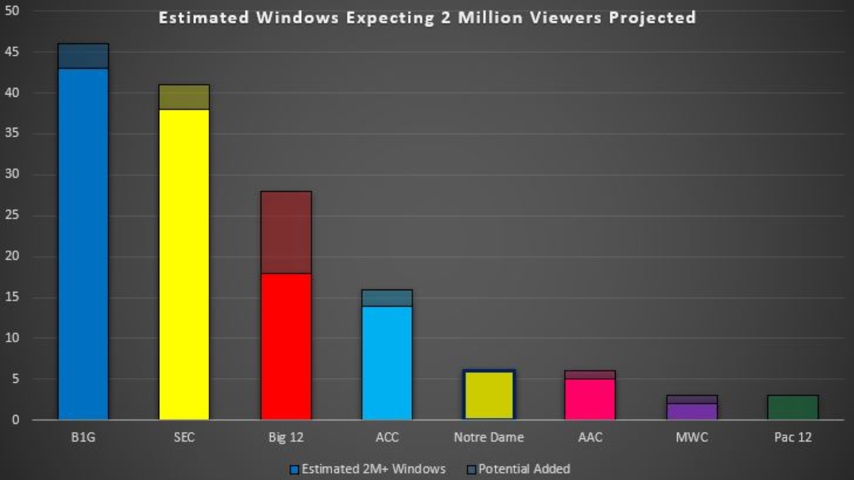

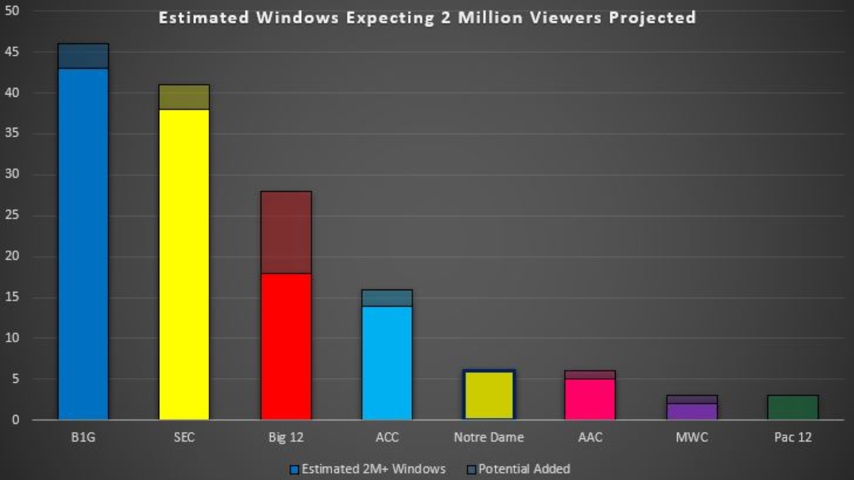

How Do The Big Windows Look Going Forward?

As a result of the new contracts with CBS, NBC, and FOX the Big Ten is getting a TON of high-visibility windows and takes the lead. However, the SEC is right on their heels with 15-16 ABC appearances and a few more big ESPN windows to make up for losing CBS and to account for their expansion with two giant brands.

SicEm365

Projected 2M viewer games by league under new deals. Low & High Expectations. (Click to Expand)

The Big 12 remains at third and simply repeating the average games on ABC or FOX they had gets us our low expectation. Even taking away the ESPN window they had prior is enough to outpace the rest. The extreme range of upside is because of how vacated FOX may be without the PAC-12. The Big Ten has 14-15 FOX games in the Big Noon slot but the Big Ten’s OTA games appear to be exclusive to NBC in prime time and CBS in the afternoon under the new deal once it starts rolling in 2024. Assuming that is true there are 14 weeks of afternoon spots and 7-8 prime-time spots up for grabs. The potential upside in the chart above assumes the Big 12 fills 9 of that 21-22 game availability.

The ACC is 4th and leaps over the PAC-12. I have them swiping one of the PAC’s ABC games and one of the AAC’s games now that three of their best have moved on.

After Notre Dame who still has their six games on NBC we see the American down 1 big window after losing two but gaining one ESPN game from the PAC. The MWC is one game up as they take a FOX game from available spots.

The PAC-12 is in a difficult spot unless ABC/ESPN, FOX, CBS, or NBC do a deal with them with contracted games in big windows. Streaming games won’t have these audience averages. If they sublicense can they get the windows on an OTA station or key windows for ESPN? It’s at best unreliable and unlikely. A streamer could sublicense to the CW as has been rumored but the CW had very underperforming numbers with LIV Golf so how much viewership are we to expect? I placed them at 3 games due to the unreliable nature of sublicensing out of a deal that figures to have a heavy streaming lead. There are plenty of options that can sublicense games (ESPN, FS1, NFL Network, Turner, CW) but it’s pretty unpredictable and not a ton of them are likely to be big windows either by reach, time slot, or by odds of casual viewership.

Conclusion

These deals can be complicated to track and while the Big Ten and SEC are running away with the best visibility it’s clear that there’s still an opportunity for the Big 12 and ACC to get significant exposure with their current contracts. The PAC-12 needs to work out a deal with some of the established players to get the kind of exposure the rest of the P5 is going to get. There is also a giant gap between any of the P5 and what we’ll see the G5 get.

Follow ,@Baylor_S11 on Twitter!