Realignment & TV Data Questions & Answers

College TV Deal & Realignment Q&A

The potential for realignment and the changing circumstances with Power 5 tv contracts have been a pretty constant conversation over the last two years in college football. In this article I will summarize some frequent topics that subscribers have had questions on. Before we begin I am offering no predictions on if schools will move leagues, whether a league signs with a specific media partner, or anything of the sort. This is simply a response to questions that have been around our board.

Is it feasible to have a graph with each channel and time slot with the conferences listed? Perhaps shade those that are locked in versus those that have options?

Sam, could you look at potential slots and partners to service an expanded Big 12, especially if we end up at 4 or more adds for football?

What options are out there for the PAC 12 on major linear players?

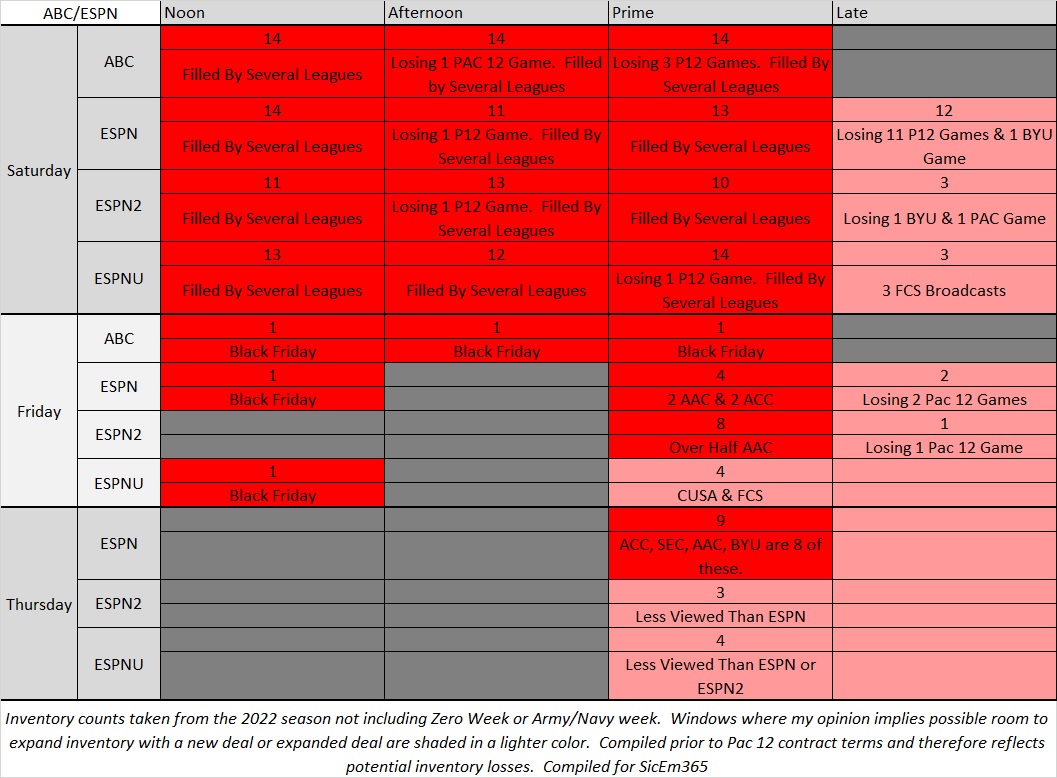

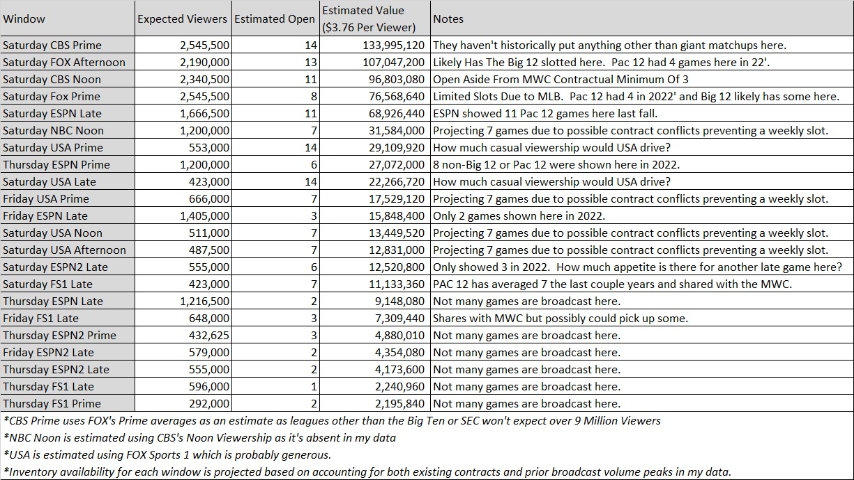

All of these questions above can overlap a bit so I am going to answer them together. Below is a look at what TV windows might have a lot of room and potential need for the broadcaster. Inventory counts are taken from the 2022 season not including Zero Week or Army/Navy week. Windows where my opinion implies possible room to expand inventory with a new deal or expanded existing deals are shaded in a lighter color. As this is compiled prior to Pac 12 contract terms being announced and therefore reflects potential inventory losses.

ABC/ESPN

The player with the most overall windows is ABC/ESPN. With that they broadcast only 7 games of the Pac 12 in 2022 that were not in the “After Dark” window that carries games after the Prime Time window. The competition here for Noon, Afternoon, and Prime window games with the Big 12 renewed is tough. However until they re-up with the PAC for a similar number of games (21 under prior deal) there should be enough room to offload their portion of a Big 12 pro-rata inventory for a 2-4 team expansion.

However should they not re-up with the PAC 12 ESPN is able to simply expand the number of ACC, SEC, Big 12, AAC, Sun Belt, MAC, or CUSA games that they put on their channels the way they did in 2020. For instance the Sun Belt had 16 games reach ESPN, ESPN2, or ESPNU in 2022. In 2020 when leagues either spent 60% of the year not playing or games got cancelled due to contact tracing they broadcast 32. If deal terms aren’t good ABC/ESPN has a deep roster of tonnage they can elevate and not incur additional cost for while admittedly getting a little lower viewer number for a better overall margin.

The biggest vacancies in their inventory are either the late “After Dark” window or Thursday & Friday on the lesser cable channels of ESPN2 and ESPNU which are decent exposure but generally draw fewer viewers than ESPN.

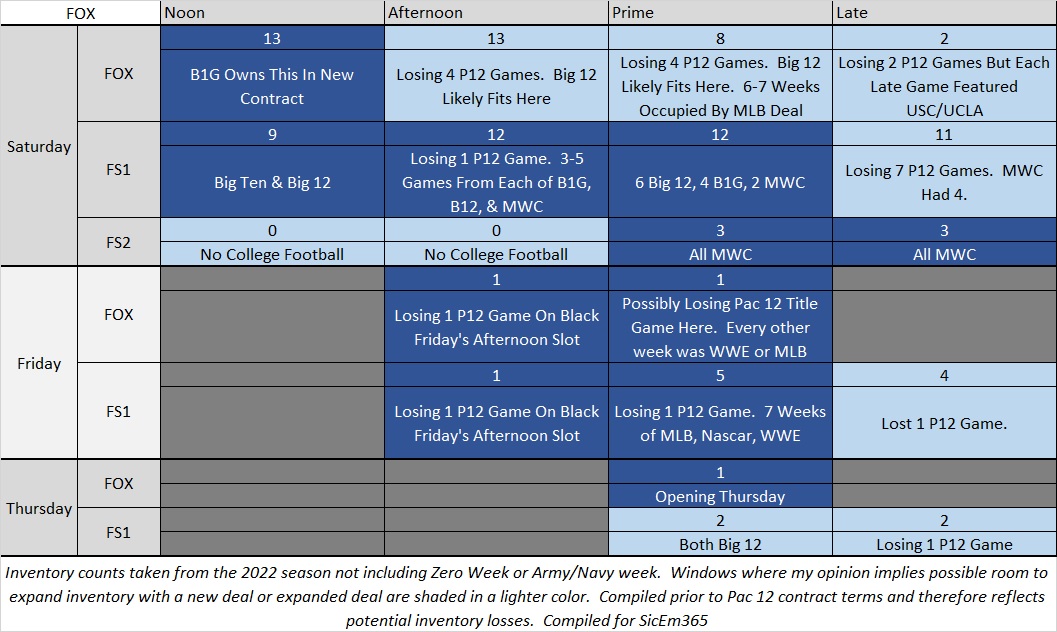

FOX

The next up is Fox. Fox represents the best combination of college football commitment, open afternoon & prime time windows, and potential lost inventory to fill the needs for either an expanded Big 12 or a new Pac 12 deal should the company find terms they agree to in either a Big 12 pro-rata adjustment or a Pac 12 contract.

With over 20 possibly lost Fox and FS1 games there’s plenty of room to fill content for either scenario we outlined assuming the prices are right. Furthermore 10 of the FOX windows are afternoon or prime time spots. WIth the Big Ten only showing on FOX in the noon slot (NBC and CBS paid to own Afternoon and Prime for the Big Ten on non-cable linear networks) there’s a gap here for Fox that either league hypothetically could fill. Fox has basically a game a week in the afternoon and half the year roughly at Prime time when the MLB isn’t conflicting. They have contracts with the Big 12, MWC, and Big Ten that depending on the year could combine for up to 81 games after the 2023 season. That won’t completely fill up the 97 FOX & FS1 spots we saw in 2022 but does a lot of it. The biggest gaps are after dark and during the Saturday afternoon slot.

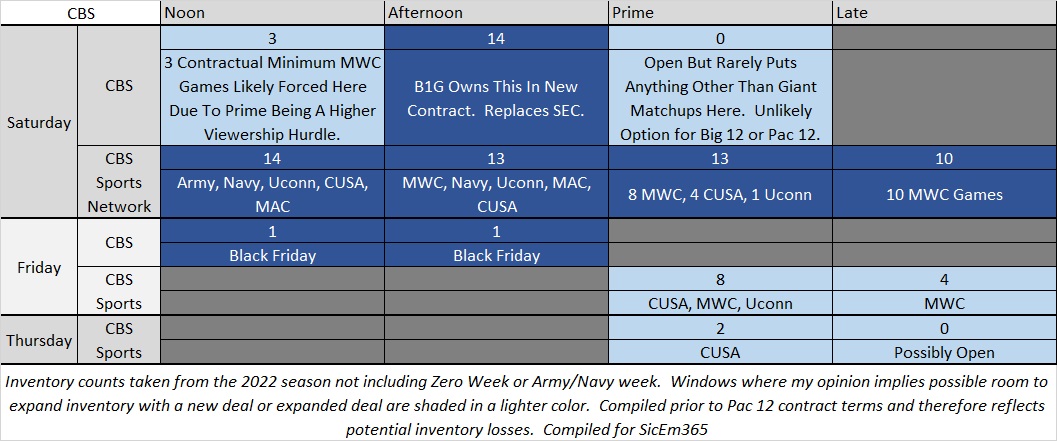

CBS

The remaining major player with the most established cable sports channel remaining is CBS. CBS could be an option for expanded Big 12 inventory should FOX pass on their pro-rata option. (ESPN is locked in, FOX can have right of first refusal for expansion) Their best availability is in that noon eastern window where the viewership hurdle appears to be much less than prime time and at least 11 weeks would possibly be options for college football. I don’t see the PAC as a realistic player in that noon window due to the 6 west coast schools and the 2 Arizona schools all operating on de-facto Pacific time in the fall and those kickoffs being extremely early. Technically they have the most openings in prime time but unless they decide to start airing much less attractive matchups than the whales they historically do I have my skepticism it’s a viable avenue here. (This does not include Army-Navy week as it’s outside the usual inventory weeks and moved back for TV)

Their cable channel CBS Sports Network could have some room on Thursday or Friday nights but generally is locked up with existing contracts on Saturday and they do it relatively cheaply. I don’t see a ton of willingness to drop big dollars on new content with either league for tonnage with the MWC, service academies, UCONN, MAC, and CUSA all signed.

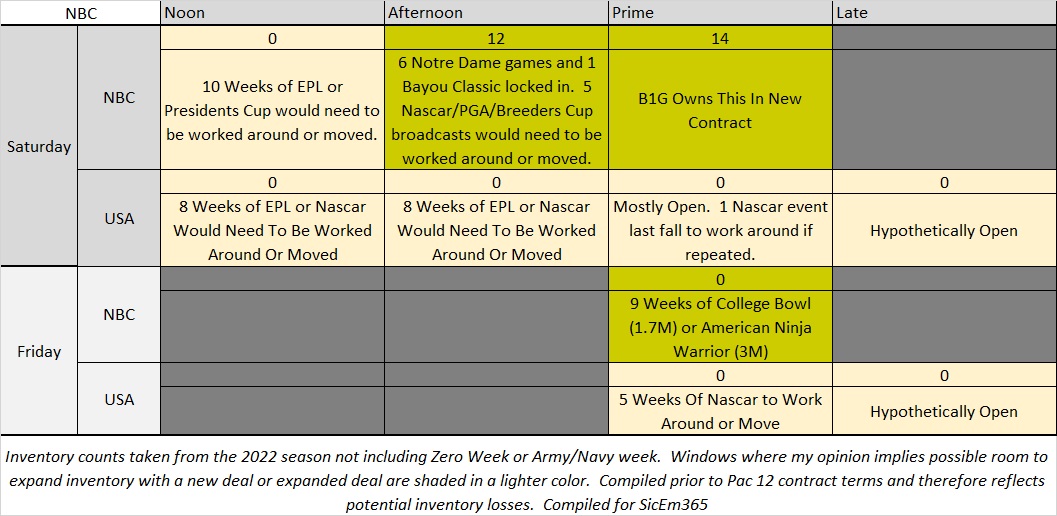

NBC

NBC recently expanded their offering in College Football by grabbing the Big Ten in Prime TIme. That will shift all their NBC Notre Dame games to the afternoon slot (6 for NBC, 1 streamed on Peacock) and between them and their other existing contracts I see any flexibility in the Afternoon slot to be limited at best. The best play for them is at Noon which makes it a “Big 12 if FOX passes on Pro-Rata” play and an iffy one at that depending on how flexible those Premier League contracts are. Could they shift games to USA or have some scheduling flexibility? I don’t know the answer to that.

Some online have speculated that USA might be an option for them as NBC no longer operates their sports cable network that used to be known as either Versus or NBC Sports Network. USA is a well distributed cable channel but not a sports one per-se. So viewership among casual fans would likely suffer but the game would have good potential reach. The Prime Time and After Dark windows appear mostly open on USA while Noon and Afternoon likely depend on how flexibile things get with NASCAR or EPL contracts.

Regarding exposure I only see one game of data for USA and it’s 2020 USF vs Notre Dame getting 957k viewers and the Irish are probably not a good comparison for either league’s viewership on USA. To fill in some comparable data I’ll draw on FX data (where FOX put cable games before FS1 and NBC Sports Network/Versus which was NBC’s sports cable network.) The games involving FBS teams that aired on FX in 2011 & 2012 that I have data for averaged 872k, the old NBC Sports Network had two Notre Dame games (2015 BC and 2017 Miami of Ohio) that went for 1.986M and 798k, and back when it was known as Versus I have data for 10 B1G, PAC, or MWC games that averaged 726k. Based on this I find the likelihood of big ratings to be low.

Other Players

The CW, Ion, Scripps, and streaming services like Apple or Amazon have also been rumored as options but the likely viewership on any of those is assumed to be much lower than the major players and I have my doubts they’d be able to deliver big dollars.

The streaming services probably represent the best possibility for deep pockets but without knowing their pricing models, potential for advertising, and what arrangements they might make to give the a league some linear games via a sublicense agreement I am not going to try to calculate what they would be evaluating. Too many unknowns.

What kind of revenue might be available for those major linear options?

I do not work for any media company but will attempt to back into a reasonable estimate using the SEC’s recent ABC contract terms for estimate price per viewer. My logic in this is that the television partners are selling advertising spots based on expected viewership so pricing based on what you could expect a league to deliver could be informative. Since the ABC deal with the SEC is for only 15 games and is all football inventory it makes for the cleanest math with the fewest variables to consider for a football-only valuation.

ABC will be paying the SEC 3 billion over ten years 300 Million per year Since the deal was for the top 15 of the SEC’s games it’s easy to estimate $20 million per game in valuation.

SInce I have years of television data I will then try and get a good expectation for those games in terms of viewership. Since it’s the same inventory that CBS was running with can take the SEC on CBS figures for the last four normal seasons which would be 2018, 2019, 2021, and 2022. I arrived at $3.76 per median viewer using the median 2018-2022 (no 2020) CBS SEC game of week of around 5.32M.

Using those figures and applying that to what was a median for whatever we are hoping to project we can at least have some data informing our assumptions.

How Valuable Are The Noon, Afternoon, and Prime Linear Windows?

Below is an attempt to guess at how much inventory might be reasonably available and to use the $3.76 per viewer we calculated above as a way to estimate what a deal for these inventory totals might add up to. Since not everyone plays in each window I took the medians for my data overall in each window rather than limiting by years or by league. I did make a couple reasonable adjustments to estimate CBS, NBC, and USA windows where either missing or unrealistic numbers were found.

As we can see the payout drops significantly if you can’t get the ESPN, FOX, CBS, or NBC spots with room for decent inventory and there’s only so much room left on some platforms due to prior contracts. ABC was not a major consideration here as it likely will try to put the expanded SEC on as much as possible and would only hypothetically lose four Pac 12 games while likely pushing an expanded SEC into those.

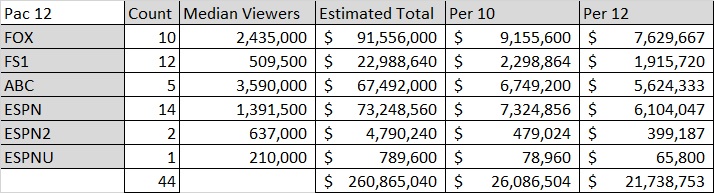

How Much Would A Renewal Of The Prior Deals Project For The Pac 12?

Below I am calculating based on Pac 12 home games on these networks and the typical quantity of appearances on each network I get the following calculations. Inventory counts and median values were based on typical inventory broadcast using Pac 12 home games from 2018, 2019, 2021, and 2022. It projects to a PAC 12 deal that estimates at 261M should ESPN and FOX opt for the same amount of inventory.

This isn’t all that far off from the 250 million ESPN was rumored to have offered the PAC 12. This doesn’t include what would remain for the PAC 12 network or for non-football.

This methodology isn’t perfect but at least provides some basis for quantifying what might be in the ballpark of what things are worth.

Is This A Reasonable Estimate?

A good sanity check on this is using the 5.1% annual escalator in the prior Pac 12 deals with FOX & ESPN that was disclosed during the O’Bannon case. Using the pay schedule from that contract and extending out 6 years (so it ends when the Big Ten does) you end up at a figure where the original 12 would have averaged 383M or 31.985M per school. However the Pac 12 was reported to have lost 40% of it’s total contract value with the LA schools leaving. Marchand & Ourand elaborate here.

That 40% would drop them to 230M or around 23M per school. My model is closer to Ourand’s comment of that being “on the high side”. A 30% reduction would place them around 26.8M per 10 teams. The Pac 12 Network could potentially add to this but depends on profitability.

My model is likely off a bit but at least gives a relative value between different window, inventory, & network combinations.

Side Note: Applying the 5.1% escalator to the prior Big 12 deal would give you around 38.8M per school had UT and OU not left prior to potentially adding the ESPN+ content that schools were rumored to be getting 3M for and would similarly escalate to around 4.6M assuming the same 5.1% increase on those rights fees for a combined total of 43M per school. If we assume their 50% reduction in total value (due to Texas and OU) and divide that 8 ways you get 24.2M prior to adding in the ESPN+ content. Apply it to that as well and you get around 29M. My estimates in my model for the Big 12 are around there.

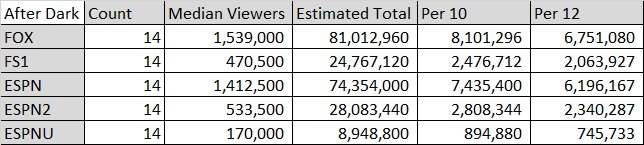

How Valuable Is After Dark?

The above comparison would make sense with prior inventory totals. However FOX Is not rumored to be heavily involved with the Pac 12 and ESPN’s involvement is rumored to be centered on the After Dark Window for the most part which is a big drawback in inventory from the prior deal. The After Dark window is a high floor for viewership averages due to lower numbers of games splitting the national audience and a low ceiling since such a large portion of the country is asleep which limits the total audience. Below I apply the Pac 12’s medians on each channel in that window and assume 1 game a week (14 weeks) for total figures.

ESPN is the top platform for late games and a weekly matchup there likely projects to around 76M annually. FS1 does much worse and might be valued at around 25 million. After Dark is a nice addition but far from the gold mine that a weekly spot on FOX in the Afternoon or Prime Time represents based on expected viewership. It can be a part of a productive deal but isn’t likely to be the tip of the spear given that not all the games are likely to be on big ESPN and very rarely would any be on FOX (just a handful over the last decade) which limits the potential upside severely.

ESPN is the top platform for late games and a weekly matchup there likely projects to around 76M annually. FS1 does much worse and might be valued at around 25 million. After Dark is a nice addition but far from the gold mine that a weekly spot on FOX in the Afternoon or Prime Time represents based on expected viewership. It can be a part of a productive deal but isn’t likely to be the tip of the spear given that not all the games are likely to be on big ESPN and very rarely would any be on FOX (just a handful over the last decade) which limits the potential upside severely.

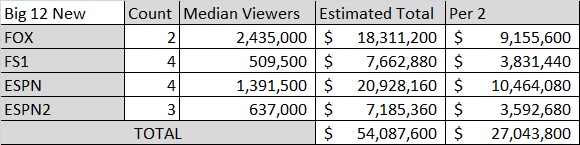

How would additional inventory for the Big 12 project in this model should they get two Pac 12 schools?

Assuming the numbers below I project their inventory could come close enough to level revenue where non-football or the additional ESPN+ inventory not calculated here (rumored 3M per school in the Big 12 under the prior contract where it was separate) could make up the difference.

It has the potential to be additive going forward but isn’t the emphatic addition that the schools that left each league would be.

IS NOTRE DAME A CONSIDERATION OF FOOTBALL ONLY, BIG 12?

The Big 12 would do it in a heartbeat. However Notre Dame’s answer?

No. Nope. No way. Not at all. Not happening.

First off their identity IS independence. It will take a lot to ever give that up.

Their football rights are hoping to get 75 million per one report. If I apply the $3.76 per median viewer to their typical 7 game home slate (median viewers in the afternoon are 2.45M which estimates 64.5M in value using the methodology above. Add to that 10M or more and growing as the ACC contract increases year over year and they get more profit from the ACC Network shares and it’s financially negligent for them to join any league other than the SEC or Big Ten and they’d still already be competitive payout wise beforehand. Additionally they are contracted to either stay independent or if they join anyone it’s the ACC unless they want to go to court.

The only potential I see for Notre Dame moving anything to the Big 12 is if the ACC ever collapsed possibly moving their non-football to the Big 12 to preserve independence and that assumes a ton of dominoes falling that may not do so.

What do TV partners value more?

- A game with a big brand vs an unranked team (Notre Dame or Ohio State for example)

or

- A game between two ranked teams, where neither are considered major brand names.

Depends on who, who’s ranked how high, and how important the stakes are. What they really want are two mega brands ranked and squaring off. There are instances of huge games involving non-elite brands getting massive viewership during the regular season (Baylor-OSU 2013 going for 6.6M is a great example) but generally speaking it’s going to favor the biggest brands playing anyone unless you have a big showdown with major national stakes on the line. The top rated games every year will be driven mostly by the blue bloods.

It's been implied during this saga that West Coast teams playing in earlier time zones have more value than playing in their own time zone (e.g. Oregon playing Texas Tech in central time has more value than Oregon playing Washington State in Pacific time). My question then is do you have an idea of what that value multiplier is? In a hypothetical example, is Oregon, playing at Baylor, worth 1.7x the value of playing the West Coast team? Just trying to get a handle on the economics that the broadcasters are looking at.

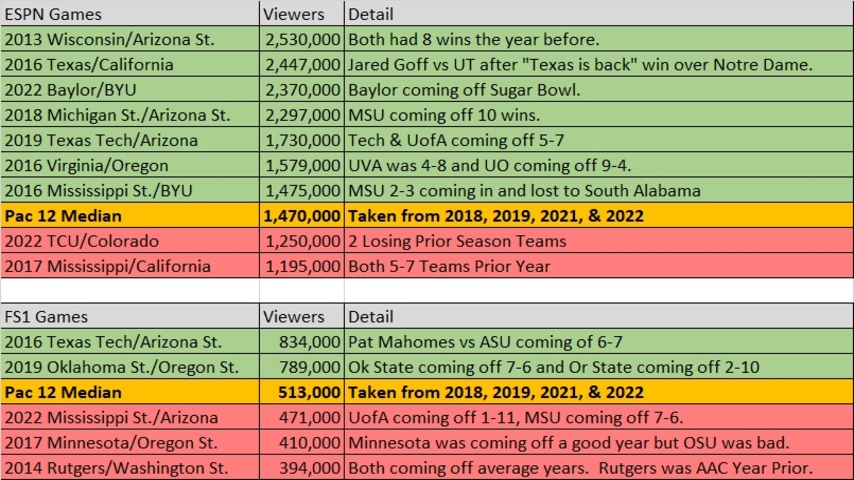

I don’t think I have enough quality data to drive a solid multiplier but I do see a trend of it helping. Here’s the P5 After Dark games where it didn’t involve a MWC, PAC 12, or Independent (BYU) facing each other since 2014 not including 2020 since there aren’t a ton of games to go off of. As you can see most of them involving teams that did well the year prior surpass the median Pac 12 after dark figures of 1.47M on ESPN and 513k on FS1 that I took from 2018, 2019, 2021, and 2022. Prior record is a major driver for September viewers which is when most of these happened.

It’s less positive with FS1 but Tech and Oklahoma State show up solidly here. There is an argument there’s probably a small benefit to cross-region but I don’t think it’s 1.5x, 2.5x, or another similar multiplier of that scale.

We've heard the Big12 wants to fill late tv inventory with potential PAC additions. If the B1G adds 4 PAC schools, or just two, how would that late slot competition affect the Big 12's (post PAC expansion) potential value and opportunity?

BearForce asked for potential slots and partners if we add 4 PAC schools. How would your answer be affected if the B1G also adds 2-4 additional PAC schools?

Any selection of Pac 12 schools would likely give the Big 12 1-4 games in that window per school depending on how many games the new additions would accept. Obviously anyone signing a deal that gives ESPN or FOX late window inventory decreases the marketability of the other leagues doing so.

There has been a lot of talk about how Louisville drives viewership for the ACC and is a great money get in multiple capacities. I've even seen media outlets go so far and say it was a mistake not snagging them back in that initial realignment period post losing A&M and Missouri. How much of this is true and how much is just part of a made up narrative? How does Louisville compare to the remaining Big 12 and incoming Big 12 schools?

Louisville’s data is somewhat tough to measure due to how many ACC games do not reach nationally rated networks. We can reasonably conclude that they weren’t valuated by the tv partners as highly as WVU given they advised the Big 12 to take the Mountaineers. We can also conclude they were not additive to the old ten team configuration. Would they have represented a solid addition this recent expansion and possibly done so over a recent addition? Possibly but it’s tough to quantify. Since Lamar Jackson went to the NFL they have 11 games that were not against top SEC teams, Clemson, FSU, Miami, or Notre Dame that were nationally rated in my data. These averaged 1.05M viewers but also never got a single game on ABC or any other non-cable network. I would assume UL ranks higher than any current G5 addition but the recent data is murky at best. They did drive big numbers during Lamar Jackson’s big years.

Beyond the magical 7 or whatever they are called in the ACC… what schools remain in the ACC outside of that 7 would potentially even increase TV viewership and maybe move the needle in the eyes of tv partners?

The ACC is under a grant of rights that lasts until 2036. Unless someone finds a clean way out of that (good luck on that one) this is not overly relevant to the Big 12 for another decade or so.

With that said we can answer it. For those who are unaware seven ACC teams were rumored to be looking at ways to escape the grant of rights last week. They are listed below:

Outside of those seven I could see an argument for Louisville, Pitt, Syracuse, BC, and Georgia Tech being at least worth pro-rata in the network’s eyes given new markets and/or history with some of the eastern schools in the Big 12. Of these I think UL and Pitt have some of the strongest arguments. I do think all of the seven except maybe UVA have strong enough media valuations to drive additive expansion should they ever be free agents.

How do UNLV and SDSU add value?

I don’t see them as additive in this contract. Combined they have exactly four games of over 1 million viewers since 2008. Notre Dame’s 2008 home opener, 2013 vs #3 Ohio State, 2021 vs Boise on CBS during Black Friday (a low competition window), and a 2012 friday matchup vs Wazzu when no other games were on. Then only 12 games above 500k including half on ESPN, CBS, or FOX. That’s not a lot of prior visibility or national draw. However each represents a solid television market and potential sponsorship money that might be viable as a long term project.

What is the best possible outcome for Baylor now and in 2031?

Other than becoming a more elite football and hoops program and driving enough media value to join the SEC or Big Ten (unlikely) the best option for any current school in the Big 12 is to strengthen the Big 12 into a clear third strongest league that merits inclusion long-term in the national title picture. Worthwhile expansion is a part of that.

Follow @Baylor_S11 on Twitter!