During the last three summers, we’ve written extensively about realignment, television viewership, league contracts and other details that aren’t exactly what you initially think of with college sports. Given this is a topic of interest on this website, I have taken some time to respond]d to subscriber questions on the topic as well as a couple of other points. Let’s get started.

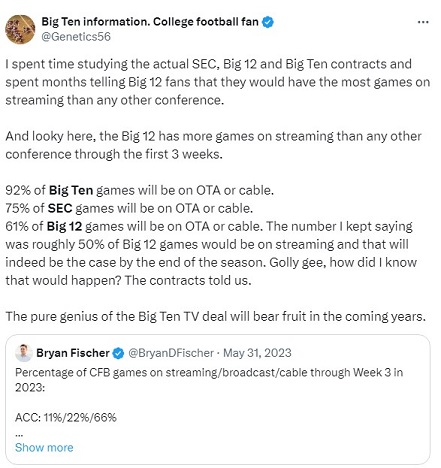

How much streaming is likely in the Big 12? Were the concerns raised by writers and bloggers that the Big 12 would be 40-60% streaming legitimate?

As a new season starts, we’re likely to see predictable clickbait go out, similar to what we saw last fall regarding the Big 12 media upside. Streaming was one talking point from last fall, with writers and Twitter “insiders” making low-context claims in some cases and outright dubious claims in other cases.

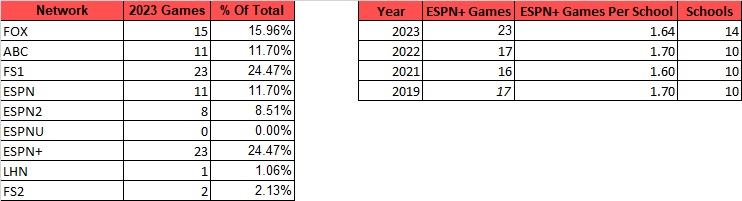

As I addressed last fall, it was an overreaction because the Big 12 schedules almost all its buy games in September, where a lesser opponent receives a paycheck instead of requesting a return trip. As you can see below, the final number didn’t even come close to 30%, much less the 40% or 50% thrown out.

We don’t know how many games will be streamed this fall as the membership expands from 14 to 16, but it will likely be somewhere in a similar percentage as the TV networks have spots to fill. Once you hit just enough inventory to force a fanbase to subscribe to ESPN+, the returns on linear ad rates become better, and there are plenty of windows for the Big 12 to claim with both network partners.

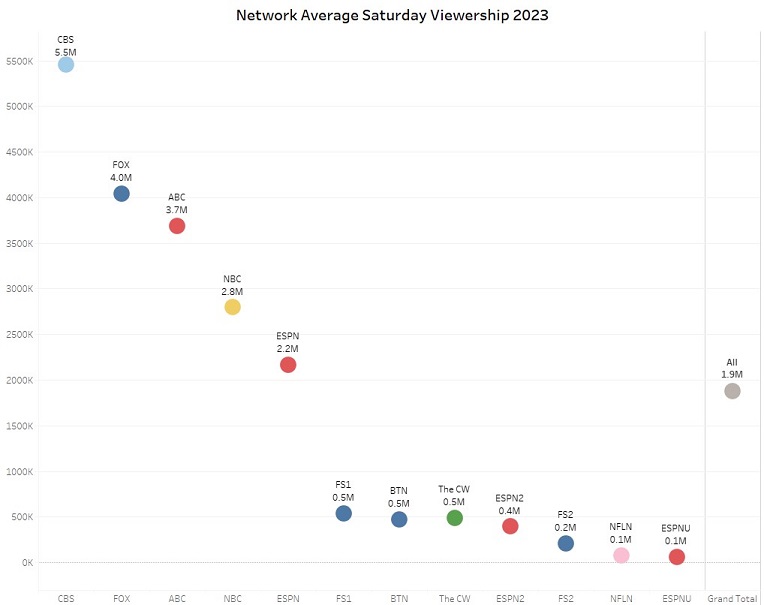

How has the new arrangement for the ACC with the CW for 13 games per year impacted their overall visibility?

After their regional syndication deal that Raycom worked through Diamond Sports was forced to move on, the ACC was able to strike a good distribution deal by getting the CW to broadcast its games. The CW is available on many television sets nationwide and enhances the overall potential visibility of the ACC home games.

However, the one downside is that while the CW is available on almost all of the USA’s television households, it hasn’t proven to be a channel that will pick up casual viewers with any regularity yet.

It is a significant national distribution upgrade, however, and can grow some over the years.

This might be a tough ask, but I would be curious about your thoughts on if the Big 12 should have kept their tier 3 rights on ESPN+ vs. pursuing a Tier 3 deal with someone like the CW to get that content over the air.

Without knowing the details of the negotiations, it’s hard to say, but I doubt it would have made sense in the context of the negotiation. The CW isn’t likely to pay much for the least marketable games, and ESPN may have dangled more exposure-friendly TV windows if the Big 12 agreed to have one-to-two games per school on ESPN+. The ACC had a carve-out for Raycom for over a decade, but that shifted over when that company’s relationship with Diamond Sports forced a new distribution partner. Those rights being carved out to Raycom likely cost the ACC revenue over the years. It was a different circumstance for the Big 12, which was negotiating an entire deal. Additionally, I think they pick before the ACC Network, so while that’s roughly one game per school, it isn’t the WORST one game per school, which probably increased the asking price. FOX and ESPN are already paying well for the Big 12’s equivalent inventory to reach national television.

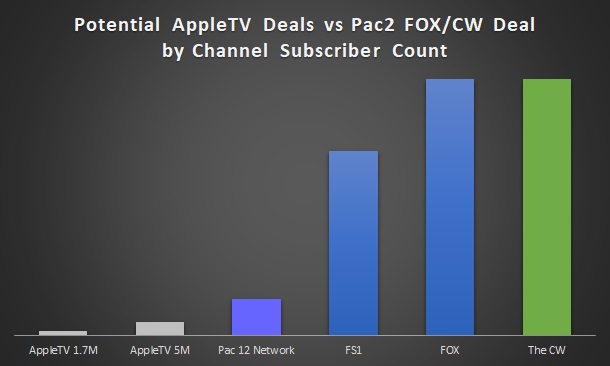

What’s the current setup for Oregon State and Washington State?

The biggest financial losses in this round of realignment will likely be Oregon State and Washington State. As I stressed last fall with Smoaky, Paul, and Craig, the Pac-12 TV deal had to nail both the payout and exposure to get everyone to lock in long-term. Unfortunately for the Beavers and Cougars, Kliavkoff could only deliver on one of the two fronts. The AppleTV deal had the base payout of 25 million below the Big 12’s 31.7 million per school, but getting 1.7M subscribers would get a similar payout to the Big 12, and getting 5M would get them 50 million per school. However, that came at a visibility cost as those subscriber counts make the much-maligned Pac-12 network’s distribution look like it’s readily available to the casual viewer by comparison.

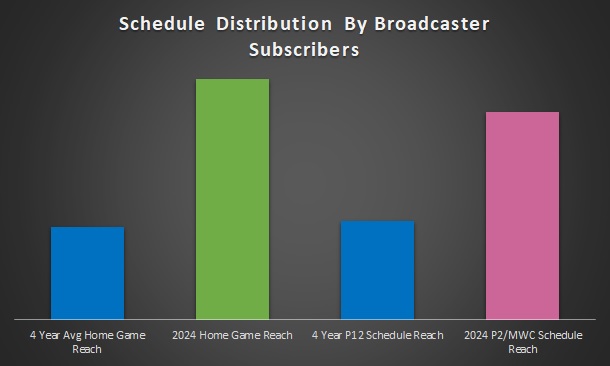

The duo have pooled the rights to their 13 home games for the 2024 season and sold them to the CW and FOX Sports, where FOX can air one game from each on either FOX or FS1, and the rest are on the CW. The CW benefits from the schools using the legacy infrastructure of the Pac-12 Network to produce the games. While the financial hit was brutal, the visibility upgrade is somehow even more of a landslide by degree. FOX has already indicated their home games against Oregon and Texas Tech will air on FOX, which means their home games are available on virtually every national TV household for at least a 20-50 times larger reach than the Apple deal subscriber benchmarks represent. The TV universe for FOX and the CW is greater than 100 million, but for simplicity, I capped the graph there since the total households shrinks year over year, and I am not sure if CW reaches quite as many as FOX.

Comparing the average reach of each network carrying their games during the last four “normal” seasons (2019, 2021, 2022, 2023) against the reach they will have in 2024 is a staggering difference. (FOX and CW estimated at 100M households, games not yet assigned between FOX/FS1/FS2 estimated at an average of FS1/FS2)

This agreement is also a pretty good deal for FOX and the CW. Below is an estimated viewership target using the estimated price of 3.76 per average viewer that I calculated from the new ABC deal with the SEC to take CBS’s old inventory. This is done based on the rumored 1 million per game reported by Jon Wilner, which is roughly 266,000 per game. Even if you only charge a pretty different $2 per viewer to get a “worst case” of around 500,000 per game. When the median FS1 game during those four years clocks in at around 560,000 and the median CW game last fall shows around 430,000, it’s a bar you’d expect to be able to hit, especially with the duo helping with production cost.

FOX doesn’t need a ton of inventory, but for a low cost, it can get a solid week two “After Dark” game hosting Texas Tech, who’s receiving votes in the preseason poll, and a week three matchup of two preseason top-25 teams in Oregon vs Oregon State. Both games should do much better than the low thresholds they need to hit to make money for FOX.

The CW wants more sports, and this is an easy way to get 11 games spread over the afternoon, prime time and late windows to pair with the ACC which gives them several over the noon and afternoon slots. For a last-minute deal, they did a great job getting visibility even at a greatly reduced payout.

In order to salvage being in a power league Cal and Stanford took greatly reduced TV revenue shares and SMU is taking NO television revenue for many years. What can the details of the revenue increase tell us about the ACC contract?

SMU joined the ACC and will not receive a share of the television rights fee for nine years, while Cal and Stanford will receive 30% for several years before receiving 70% for two years. After that, all three will receive full television revenue shares. However, there are many misconceptions about this.

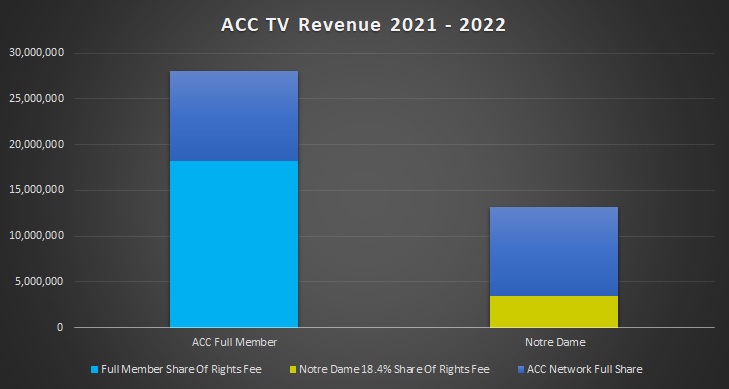

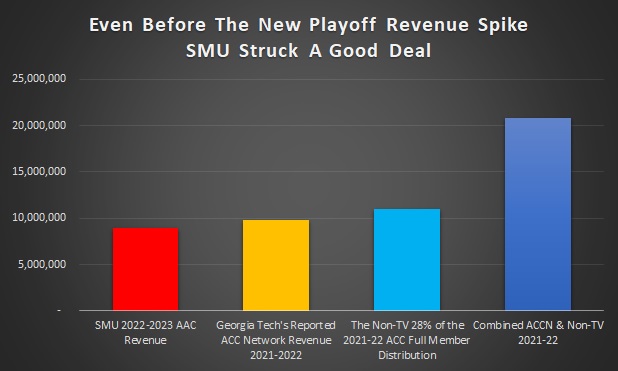

Firstly, the ACC has two main television revenue streams. They have a base rights fee similar to the Big 12’s deal, but Notre Dame only gets under 20% of the value of a full share as they are a non-football member, and football drives just over 80% of the revenue. The conference also takes 50% of the profits from the ACC Network (ESPN takes the other half), and every member, including Notre Dame, SMU, Cal and Stanford, will have a full share of that. Using a combination of FSU legal documents outlining rights fee schedules and Georgia Tech’s reported revenue from the ACC Network that year, we can represent the breakout for 2021-2022.

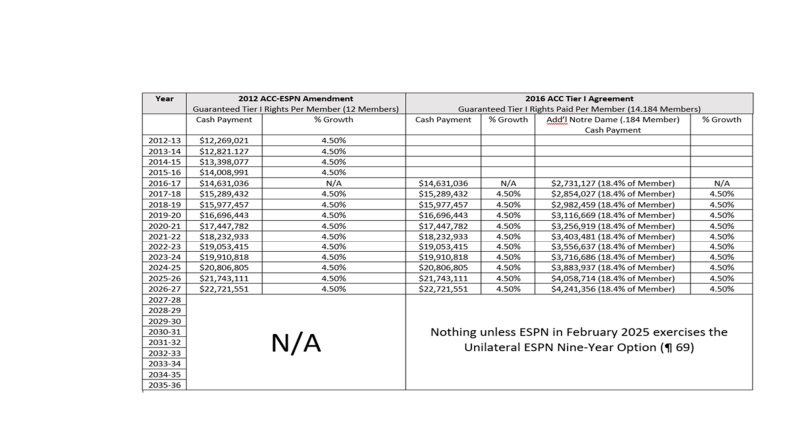

Several numbers are floating around, so let’s try to get accuracy on them. One report stated that a result of the expansion it was reported that the ACC’s television rights revenue from the ESPN TV deal will grow around 600 million dollars over the 12 remaining years on their contract. However, if you back those numbers out that appears to conflict with the FSU legal document schedule pictured below.

Dividing the $600 million by three schools over 12 years yields only $16-17 million per school pro-rata, which is below what is already being paid for rights fees. So we need to estimate with the larger number, which would imply around $21 million this year and an average of just under $27 million per year if we apply those 4.5% increases through the 2035-2036 school year.

Dividing the $600 million by three schools over 12 years yields only $16-17 million per school pro-rata, which is below what is already being paid for rights fees. So we need to estimate with the larger number, which would imply around $21 million this year and an average of just under $27 million per year if we apply those 4.5% increases through the 2035-2036 school year.

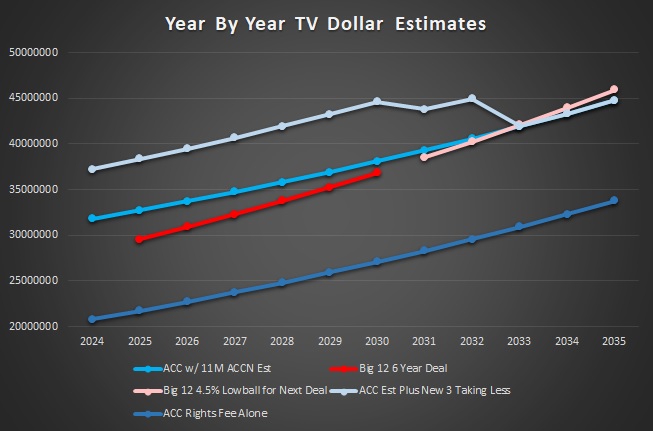

This creates just over $700 million to split among the existing members. Using these numbers, using 1/14th of a current year’s sharing pool as a bump, and assuming $11 million for the ACCN we can estimate how this looks over time for the ACC. Additionally, I have projected out the six-year Big 12 rights fee deal with 4.5% increases and also subbed in a lowball estimate for the next deal, which is simply the current estimate continuing with 4.5% increases.

To me, this implies that the Big 12 was on pace to nearly catch the ACC toward the end of the current deal and will probably pass them with a subsequent deal if rights fee valuations keep going up. The Big 12’s newest television deal exceeded the simple 4.5% increases you would have expected for the remaining eight on the prior deal by around 8-9M. To estimate that, I used the 50% of the contract value not attributable to Texas and OU divided by eight schools and applied the 4.5% annually to that number and compared it to an estimate of the yearly amounts for the six year deal the Big 12 signed using 4.5% annual increases. I don’t expect a bump of nearly 10M again, but I expect a solid bit more than the estimate above unless the market shifts wildly.

How good or bad was SMU’s deal for them?

What this tells me is that SMU struck a great deal. Its entire share of American Athletic Conference distributions for 2022-23 was less than two of the revenue sources that the ACC will share with them now despite the comparison figures for the ACC amounts are years old and likely below what we will see them share.

On the ACC Network side, the trio should come close to breaking even for the league at worst. Even if they only get those two DMAs to pay $1.30 per subscriber instead of $0.25, that will go a long way toward meeting their benchmarks. Those DMAs have around 5.6 million television households combined and nationwide the US currently has around 72.5% paid TV subscribers either traditionally (cable/dish) or digitally. That projects to 12 months of charging over four million homes $1.05 more than they used to, which generates over $51 million in gross revenue. When ESPN takes its half, and each of the three divides the rest, it’s a starting point of $8.58 million. That’s before ad sales and production costs, but ESPN should be able to sell more ads relative to how their costs rise.

The question on the upside is how much ESPN can use existing contract language to force DMA outside of their home DMA to pay up. Do they have contract language to make all of Texas pay up because they have SMU? I imagine cable providers would riot down in Houston or Austin at that idea. Former Fox President Bob Thompson implied that the prospect wouldn’t go over well with distributors.

At least one media report implies Thompson was right.

“Michiaels said the ACC Network will receive in-market carriage rates from cable and satellite companies in Northern California and Dallas — two of the 10 largest markets in the nation — after adding California, Stanford and SMU over the summer in a divided expansion vote.”

Regardless, this deal is an absolute slam dunk for the Ponies and a much better financial outcome for Cal and Stanford than rebuilding the PAC probably would have been.

What is your expectation that the Big 12 could actually add ACC teams? We saw with the PAC that overcoming institutional inertia was extremely difficult and up to the final hour (and even after) they have had programs lament the circumstances that forced them to the Big 12 rather than viewing the situation as a willing partnership. How many programs does the ACC need to lose to make that similar movement?

The ACC situation is different from the PAC in that they have significant exit fees and a GOR and are not facing an existential crisis. The ACC will continue without FSU and Clemson, and their presidents will only solidify over time with their institutional associations with Cal and Stanford. The question would be what amount of movement is required to break that mold and pay the price for departure.

The Big 12 needs a significant additional revenue source and something to happen in favor of Florida State/Clemson in their legal fight with the ACC.

Firstly, if the grant of rights is firmly upheld, the cost is prohibitive enough to dissuade a move for any of them.

Even if that’s resolved, you probably need significantly more revenue to lure those two, or you need the Big Ten or SEC to strike at the ACC first to free up others who may be more realistic. There is also the exit fee in addition to the GOR, and the biggest brands in the ACC aren’t doing this to make a pretty lateral move to the current Big 12 media deal.

Whether that media deal gets significantly enhanced by a motivated broadcaster or whether it’s the rumored private equity play, it’s going to take a heavy influx of cash to make anyone move to the Big 12. Never say never but like a fourth quarter comeback a lot has to break your way.

Could the SEC and Big Ten have an interest in FSU and Clemson?

The two leagues haven’t publicly indicated a big interest in either. It’s fair to question if the television value is enough to clear some extremely high hurdles. For instance, Washington and Oregon are solid brands and couldn’t initially make sense for the Big Ten contract at full value. They will be making roughly half when they join, as that did make sense for FOX to pay the freight.

However, there may be another thing occurring here.

I could see the SEC or Big Ten showing interest if the legal concerns were resolved. Nobody wants to get involved in a risky legal situation, whether it’s the legal liability of interfering in a contract and getting sued or potentially taking on a school that left their TV rights in their prior league and significantly dilutes the revenue for the existing members if they lose in court.

Even if they publicly say they have no interest—that’s not having interest right now. Perhaps that wildly shifts with legal concerns resolved and the upside of more media rights value for the league courtesy of a school that proactively approaches them, which absolves the new conference of any interference claims. That’s a wildly different legal scenario than the current status of the two schools.

There is a potential bottleneck, however. The addition of Washington and Oregon to the Big Ten only happened because FOX paid for it using an expansion of their TV windows into Friday nights, which covered only about half of the value that a Big Ten full revenue share represents. Is there a broadcaster who...

- Has the available windows to get exposure and potential viewing upside to make sense

- Has a reasonable expectation to monetize them enough to pay such high dollars

- Has the ability to buy the rights that aren’t blocked by exclusivity in either league’s contracts. If the additional rights are contractually promised to ABC/ESPN, for instance, it won’t matter if Amazon or Turner wants to pay up. It’s unclear how those contracts are written for any of the Big Ten, SEC or Big 12 until I see the contractual language.

That part is unclear and has little to do with whether the two are valuable in a blank-slate comparison.

How would you value ACC and Clemson?

Unlike the Pac-12 without USC and UCLA or the Big 12 without Texas and Oklahoma, I do not have a specific media quote where consultants are valuing these brands as a percentage of a known figure, which is a more comfortable analysis. As a result, we’ll have to approximate their viewership and guess using the estimated revenue per viewer I used in a prior SEC contract mention.

The duo averaged 3.29 million viewers per nationally rated home game since 2013 on national broadcasts in my data. When we apply $3.76 per viewer that I borrowed from my shorthand math on the SEC contract and multiply that by 16 home games per year, the duo comes out to around an estimated $198 million per year or 99M for each. That is probably a little high as not every game was nationally rated, and they only averaged five per school since 2013 (excluding 2020), so those last two to three games wouldn’t price as high. A high of $100 million each and a low of $60 million is probably fair, with it likely north of $85 million. However, this is a very basic guess.

How would the ACC perform without FSU/Clemson?

It’s no secret that FSU and Clemson make up the lion’s share of the top TV windows in the ACC. That is massively going to impact any simple analysis for the other 12-15 teams. This is why so many of the Big 12 comparisons to the AAC in 2021 were so flawed or ignored sample sizes and television window differences in the 2022 Big 12/Pac-12 analyses were so far off. The quality of network and television window matters and we have to take that into account.

If I wanted to do a hatchet job on the numbers and paint the worst picture possible for the remaining ACC schools, I could make just as convincing a case as Mandel tried to make back in 2021 with the Big 12. Conference games in 2023 involving Clemson or FSU averaged 2.9 million, while conference games without them only averaged 1.08M, which is less than Mandel’s doomsday figure for the 2021 Big 12 article. However, that would be a very flawed comparison as it takes away all but three of 21 appearances on ratings giant ABC (similar to the two out of 25 that Mandel left the Big 12) and leaves the other games for ESPN, ESPN2 or the CW. Of those, only ESPN could reasonably expect big ratings.

So, how do I plan to approximate this? My rating data categorizes games by time slot, day of the week, network and it calls out specific weeks and events like Labor Day Week or the ACC Title Game, where viewership is expected to be different. Using the three-year average of TV window appearances for the ACC and applying how the other ACC schools performed in them to those figures, I can get a more reasonable estimate. I included 13 CW games per year despite it being a one-year consideration since that deal will continue for the next handful of years.

After making a couple of adjustments for missing comparison data, such as using the older 2014 Miami-Louisville on ESPN Labor Day to stand in for Sunday ABC and Monday ESPN prime time windows on Labor Day weekend and using data older than the simple three-year window to approximate Saturday ESPN noon games, I arrived at a fairer estimate.

Last 3 Years of ACC14: 1.81M

Estimate if Other 12 Filled Those Windows: 1.61M

The difference is roughly 208k per game but it’s nearly half a million more per game than what the simplistic analysis would have implied.

However, without those two ratings draws, it’s possible that ABC/ESPN put more SEC, Big 12, AAC or other league content on during those ideal windows. For instance, a title-contending Florida State probably had a lot to do with the ACC getting 22 ABC games in 2023 compared to only nine in 2021. Considering the American Athletic Conference averaged two more ABC games and two more ESPN games from 2017-2022 (excluding COVID 2020) than they did in 2023 after losing Houston, UCF and Cincinnati, it’s a fair consideration to project fewer big windows without specific brands.

If I do the same analysis with the less favorable 2021 windows for the ACC and add in the CW games for an even comparison with the earlier method, the numbers shift to:

Estimate for Lesser Window Model: 1.35M

It’s a bigger hit with around 460,000 viewers. Even still it’s roughly 300k more than the lowball doomsday figure per game.

They’d still drive better numbers than any G5 if Miami, North Carolina and company were still around. The estimated rights fee revenue loss is mitigated due to the combo of Miami, Virginia Tech and others providing brand value and a large amount of inventory available to backfill the departures, especially after adding three schools worth of inventory. However, if they lost carriage fee rates in key markets that would be an additional hit.

What kind of viewership do you expect to be needed for the FOX additions of Oregon and Washington to the Big Ten to break even?

If we use the estimated revenue per viewer, I roughly estimate the SEC/ABC deal, and we consider that FOX is airing 9 Friday night games, but paying for the estimated 13 additional Big Ten games that Oregon and Washington represent the hurdle they need to hit is very manageable.

UW and OU will average 32.5M each over the six-year deal. That’s roughly 65 million in total for 13 games. If the four FS1 games average around 600k (FS1’s typical average in recent years of my data), that would mean the nine FOX games need to hit 1.65 million.

Prime Time Friday ESPN games averaged around 1.5-1.6M over the last few years. That number is very feasible given the Big Ten has bigger brands than the AAC/ACC ones driving the ESPN Friday since their biggest three brands aren’t on typical Friday windows driving these numbers and FOX should be a channel getting significant attention on par with ESPN.

Are there any schools out there that would be additive to either B10 or SEC media rights contracts going forward, including Clemson and FSU?

And, is it possible that ACC, Big10 and SEC might actually push out currently unattractive (to media) members so as to increase their take of rights agreements? If so, who are those candidates to be dropped?

There’s an argument for some ACC schools to be additive, but the hurdle to hit is incredibly high these days. It will take not only valuable brands but also the right market conditions to monetize them effectively.

As far as pushing out existing teams, I won’t rule anything out but I would be surprised. If it did happen I would expect it to be a MWC style “airport meeting” where schools just form new groups and leave old schools behind.

Do the Big 12 TV slots cap their numbers, making it impossible to substantially improve their position?

Is it possible to establish a performance target for time slots and networks that allows for a game to be rated based on performance against expectation, not just total rating? Sort of a WAR for games in a time slot.

TV windows can dictate a lot regarding viewership, but you need an attractive game to drive the numbers. However, the Big 12 deal has enough flexibility with FOX and ABC/ESPN to get visibility nationally on three solid networks for ratings. The projected well on how many big viewership windows we can expect when I wrote an earlier article.

I don’t see the networks modifying their criteria for something like that unless you have a compelling case that it makes them money.

What are the odds the future remnants of the ACC raid the Big 12 for WVU, UCF, etc.....

I doubt it on both sides. The Big 12 teams have a grant of rights and an aggressive exit fee to deal with for a pretty lateral move. Why pay up for a similar payout?

On the ACC side, it’s likely that Cincinnati is the only one of the eastern schools that’s new turf for ACC Network carriage rates since the DMAs West Virginia and UCF help with overlap Virginia Tech/Virginia/Pitt or Florida State/Miami who already deliver full charge in those DMAs. So, the upside isn’t really there for the ACC Network subscriber base to make it an attractive play. Also, the ACC would need a compelling reason to go past 18 teams, and none of our group is likely to surrender 85-100% of their rights fee revenue over a nine-year period like SMU/Cal/Stanford did to make the pro-rata increases profitable.

Additionally, if the ACC loses teams, you have much less likelihood of a competitively strong deal to draw teams in. Joining up with the anchor brands of Florida State, Clemson, Miami, Virginia Tech and North Carolina is one thing. Joining up with the anchor brands of Boston College, Stanford, SMU, Cal and Wake Forest is another.

Where does Baylor, specifically, land in an apples-to-apples comparison to other schools regarding football and basketball viewership?

Yes, I understand that this is a difficult comparison because you need to account for network, time slot, competing games, opponent, and how good/bad the Bears are in a given year.

I'd just like to know if we're closer to the 30th most-watched program or the 50th. Thanks!

Honestly, it depends on what time range you sample. Baylor and most of the Big 12 are variable based on recent success. The historical brands are more insulated from that but still vary some. When I did a simple and quick nationwide analysis in 2022, it had Baylor at 28th, but we’ve probably fallen 5-15 spots due to 6-7 and 3-9 seasons since. I have not had time to re-run that analysis, but I may at a later date. Ideally, I’d work on a more nuanced model that accounts more for network but it will take time.

Hi. I've got two simple questions I think that will help me understand the final end goal of consolidation and alignment.

If we simply calculate how many TV slots exist across the major network channels, how many college football games currently exist Thursday-Saturday each fall weekend?

If we take the answer to the above and calculate how many NCAA brands get airtime any given weekend (Ex. 35 games = 70 brands/Universities). Which brands fill those spots top down as most lucrative to the major networks?

Last year I broke down what the major networks looked at covering ABC, CBS, NBC, FOX, ESPN, FS1. Since then we’ve seen FOX expand its Friday nights with 13 games and the CW project to have a combined 24 ACC/Pac-2 games this fall.

Adding up my old chart and 24 CW games and 13 FOX/FS1 Friday games, we get to roughly 453 games across these networks. Over 14 weeks, that’s 32 games broadcast, as a rough estimate. This doesn’t include league networks, ESPN+, Peacock or other smaller channels.

At 6.5 home games per school, that estimates 70 teams and eight games per school would estimate 56. If we limit it to ABC, CBS, FOX, NBC and ESPN, we get a total of 204 games. That’s 14-15 big channel games per week and 25-31 teams' worth of content.